Dbs Time Deposit

Posted : admin On 3/28/2022 At a Glance

At a Glance- For a full suite of services, click here for DBS/POSB digibank or iWealth. With safe distancing measures in place at our branches, customers are encouraged to take queue numbers via our SMS Q service before visiting our branches. This is so you may arrive just in time to be served.

- PIA Features & Benefits (Applicable for Singapore dollars Fixed Deposit only) Choice of tenors from 6 months; Earn additional 0.10% p.a. Interest #, added to the prevailing board rate for your deposits; Automatic renewals: Upon maturity, your deposit.

Your fixed deposit will act as a contingency fund i.e. A fund created to tackle emergencies and unforeseen developments, and should be equal to 3 to 6 months’ worth of your expenses. Why Are digibank FDs the Best Contingency Funds? Maximum deposit amount of $75,000 and 3 to 18 months tenure DBS current highest fixed deposit rate is 0.60% p.a. For 8 months tenure with maximum deposit of $19,999. There is currently no fixed deposit promotional rate for DBS Fixed Deposits. The current highest fixed deposit rate is a DBS board rate.

At a Glance

You need flexible, convenient and instant deposit and withdrawal services to meet your daily needs. DBS has several RMB savings accounts to choose from. Find the one that’s just right for you. ;;;

1. RMB savings accounts

Account types | Benefits | Minimum balance requirement |

|---|---|---|

RMB personal settlement account* |

| CNY1 |

RMB remittance savings account (Limited to residents of Hong Kong SAR) |

| CNY1 |

RMB remittance savings account-Self Name/Third Party (Limited to residents of Taiwan Region) |

| CNY1 |

2. Foreign currency savings account*

- Choose from 10 currencies: USD, HKD, JPY, EUR, AUD, CAD, GBP, SGD, CHF and NZD

- USD and HKD cash services

- AUD and SGD cash services (only available at selected branches)

- Flexibility and convenience with no minimum balance requirement

* This account is only available for clients who are 18 years or older. For customers who are younger than 18 years old and wish to open the Account, a Minor Trust account or Minor Non-Trust account may be opened in the company of his/her statutory agent.

For CNY cash withdrawal amount of ≥ CNY 50,000, or foreign currency amount ≥ USD/HKD/AUD/SGD 5,000 (in Shenzhen area, for any AUD/SGD cash withdrawal, USD cash withdrawal amount of ≥ USD 1,000, or HKD cash withdrawal amount of ≥ HKD 10,000), please raise a request through the branch or your relationship manager before 12 noon, one working day in advance.

How to Apply

Visit any of our branches

Call our DBS 24-hour personal banking hotline at 400 820 8988

Useful Links

Topics

Deposit Details

Dbs Time Deposit Hk

| 8 mths | 12 mths | 18 mths | |

|---|---|---|---|

| $1k to <$20k | 0.60% p.a. | 1.15% p.a. | 1.30% p.a. |

Enjoy 0.60% p.a. for 8 months fixed deposit

Interest rates are applicable for minimum placement amount of $1,000 and maximum amount of $19,999

Interest rates for tenors of 8 months and below are applicable for all customers

Receive 1.30% p.a. for 18 months fixed deposit

Receive 1.15% p.a. for 12 months fixed deposit

Receive 0.95% p.a. for 9 months fixed deposit

Interest rates for tenors of 9 months and above are applicable only to rollover of existing placements at the same tenor

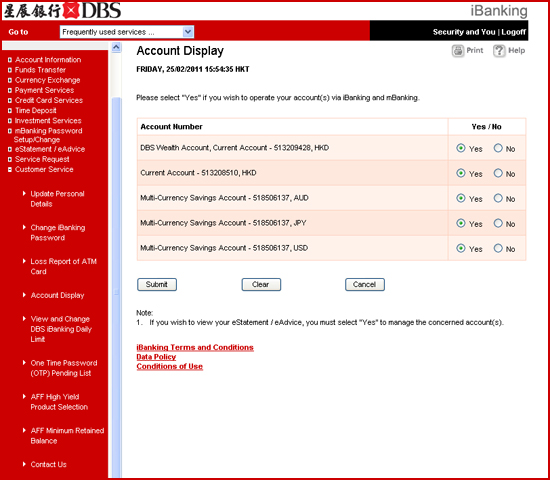

New placement may be made via iBanking or at any DBS branches

The DBS Fixed Deposit Account gives you the opportunity to maximise your savings with attractive interest, while keeping your funds secure

Click here to go to DBS website for more details about DBS Fixed Deposit Rate.

DBS Bank Hong Kong - Online Time Deposit Offer

Historical Chart and Deposit Rates

* Interest Rates based on highest fixed deposit rate with

maximum deposit amount of $75,000 and 3 to 18 months tenure

DBS current highest fixed deposit rate is 0.60% p.a. for 8 months tenure with maximum deposit of $19,999.

There is currently no fixed deposit promotional rate for DBS Fixed Deposits. The current highest fixed deposit rate is a DBS board rate

The current Money Lobang National Average Fixed Deposit Rates for March 2021 is 0.46% p.a.

The average monthly highest fixed deposit rate for DBS since 2018 is 1.23% p.a.

See All Results For This Question

DBS has not had any fixed deposit promotional campaigns