Time Deposit Rates

Posted : admin On 3/24/2022What Is A Time Deposit?

A time deposit, also referred to as certificates of deposit, is a fixed deposit at a bank, which you will not have access to during the agreed time period in exchange for a higher interest rate compared to a savings account. Identical to an investment account, you will be eligible to a higher premium rate as a return on your investment. Time deposit investment rates generally differ from interest range of 1.00% to 5.00%.

Time Deposit Tenure

0.250% - 0.875%. Over the counter. Time deposit placement confirmation.

Usually time deposit terms vary from 1, 2, 3, 6, 9 or 12 months. But with other banks, they can offer to an extent of five to six years. Regarding the maximum time deposit tenure, it would usually depend on the depositor who has full control on the tenure. In general, time deposit terms shift from 1 to 12 months. Whereas different banks can also offer to a degree of up to five to six years.

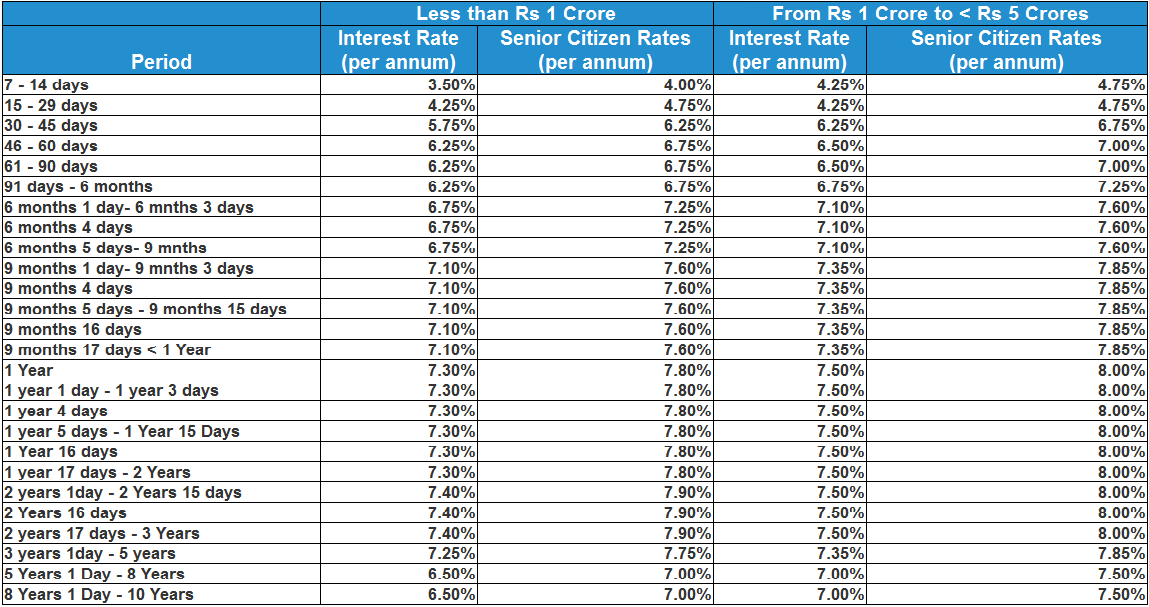

Time Deposit Rates Bdo

View time deposit rates. 365 Days: 2 Years: 1K to less than 10K: 0.0000. The preferential time deposit interest rate in this promotion material is quoted based on the interest rates of Hong Kong Dollars, RMB and Foreign Currencies time deposits published on 2 March 2021 by BOCHK and is for reference only. The preferential interest rate is a one-off privilege for each time deposit and the subsequent renewal rates.

Time Deposit Fees And Charges

Are there any charges when I invest my money in a Time Deposit? Yes, there will be charges. Interest earned on time deposits is subject to a final tax of 20%. These are charged every month when an interest is earned on your account. Aside from taxes, it is also subject to stamp duties if the principal amount exceeds ₱250,000.00, in which you will be charged ₱1 for every ₱200 after it.

Time Deposit Requirements

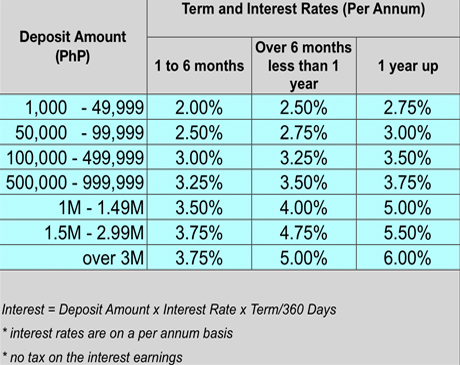

Time Deposit Rates In Philippines

The only requirement for a time deposit is, that you have available funds which you will not need to access over a certain amount of time. Depending on the bank, there might be a minimum amount or limitations regarding the time period. But in exchange for all the copies of identification and initial amount you will give to the bank, the bank will give you a certificate of time deposit.

Is Time Deposit Worth Investing In?

Time Deposit Rates Bdo

Certainly! If you are a person who is risk-averse and have very little risk appetite, time deposit is definitely for you. What makes time deposit an ideal investment option is that the returns are continuous and predictable. It is pretty straightforward and there are certainties. You just have to wait for the waiting period to be finished and you'd expect a specific earnings at the end of it.

How To Find The Best Time Deposit Interest Rate?

Time Deposit Rates Usa

There are various offers by banks in the Philippines. We have put all of them together and created a comparison tool, which presents you the best interest rates based on your available savings and the time period. Needless to say, the usage of our comparison tool is free of charge. Once you have found the most favorable bank you may apply for it online.